It was Benjamin Franklin who said, "An investment in knowledge pays the best interest." This is likely most true in the realities of today's financial scene. Learning and acquiring key skills cannot be overemphasized in the uncertain waters of investing.

Today, many financial enthusiasts are looking for their next major venture. More often, they are uninformed, and they turn to the investment markets. Unfortunately, the volatility of the investment market causes things to be unpredictable for such uninformed enthusiasts.

Value Corevia presents a way to receive this much-needed education. Registering on the Value Corevia website allows anyone to begin the journey to financial literacy. Value Corevia connects all registered users to investment education firms free of charge.

The Value Corevia website is a modern-day attempt at solving the age-old problem of widespread financial ignorance.

To curb widespread financial ignorance, the Value Corevia team partners with investment educators. Value Corevia does not offer investment education; instead, it connects users to a student-centered tutoring firm.

Anyone can take this first step to investment education by registering on Value Corevia. The website helps put learning about investments within the reach of just about anyone with access to the web.

How does one get started on Value Corevia? Very simply, really. One does not need to pay any fees or upload any documents.

One also does not need any experience with investments. All that's required is a desire for financial literacy. The Value Corevia team ensures seamless registration.

Complete the Value Corevia online registration form by providing the requested details: name, email, and phone number.

Leave the rest to Value Corevia! The Value Corevia team will handle the process and connect users with an appropriate investment education firm.

Finally, start the investment education journey after a representative from the assigned education firm reaches out.

Investment education boils down to sharing knowledge about investments. It entails an understanding of market fundamentals and learning strategies for risk management.

Before Value Corevia, getting an investment education could rival rocket science in complexity. This is because those who realized they needed some investment education couldn't make out which information was appropriate or relevant. Value Corevia changes that by linking its users to investment educators. These tutors provide not only the information they are looking for but also clarity on what may confound them.

Anyone looking to weave their way through the current shifts in the financial scene needs to understand it first.

Everyone is on the lookout for the next big thing. However, one may easily be misinformed, making it vital to get educated about financial markets. Value Corevia is a free link to investment educators. Start the journey to investment literacy and informed financial decisions with Value Corevia.

A desire for knowledge is really just a need for a teacher. Investment educators simplify complex investing concepts for the average person. They don’t just share information; they use personalized approaches to reach each student. With Value Corevia, the search for investment educators has been made easier. All that is needed is to fill out the form on the Value Corevia website.

At Value Corevia, our mission is to eliminate barriers and make financial literacy accessible to everyone. Value Corevia provides multilingual support in all major languages, ensuring users can sign up in their preferred tongue—completely free of charge. Even better, Value Corevia charges no registration fees. By registering on Value Corevia, users will gain access to investment educators who will teach users how to:

Understand Financial Markets

Essentially, trying to learn fundamental and technical analysis to maneuver in the investment world is part of investment education.

Assess Investment Vehicles

Investment education also teaches things such as types of investments (i.e. stocks, real estate, etc.) and alternative investments (i.e., cryptocurrencies, etc.)

Navigating Regulations

A third aspect of investment education is learning the rules that govern the financial market to understand how the technical and the legal interact.

Value Corevia is a modern means by which the average person gets in contact with those who teach how to navigate complex investment markets. An example of a complex investment market is cryptocurrency. Value Corevia provides links to education on evolving investment market regulations and new investments.

These days, anyone with a smartphone can look to become an investor. But there’s much more to investing. For one, it has a psychological side to it. People should first learn as much as they can before buying any asset. Value Corevia promotes financial literacy for informed financial decision-making.

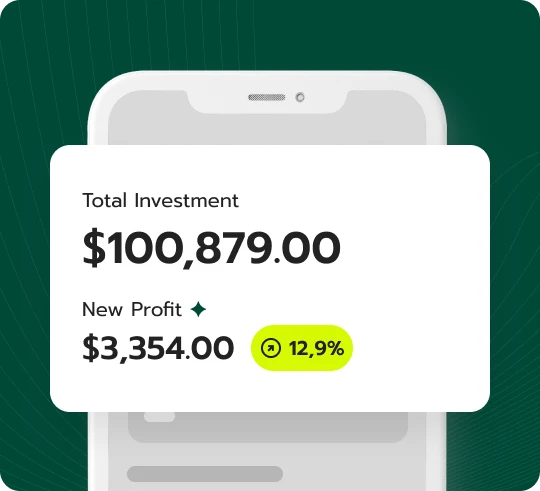

Investments are widely discussed online, yet many lack a clear understanding of them. In essence, an investment involves dedicating resources—money, time, effort, or energy—toward a specific goal or opportunity. The principles of risk and return are key to financial investments.

Investments come in various forms, referred to as asset classes, each serving possible unique purposes, such as covering expenses or building a legacy. Getting investment knowledge empowers individuals to explore their financial options.

Approaching investments without knowledge can be dangerous. The associated risks are too high to rely on emotions or internet trends. Value Corevia connects users with investment education providers, enabling them to navigate the financial landscape and make objective decisions.

Investment activities play a significant role in shaping the economy, with both positive and negative effects. It is important to learn about investments, and Value Corevia is the link to a suitable educator. Negative impacts may include inflation and economic instability caused by fluctuating investment values.

On the flip side, investments may bring about positive outcomes, such as job creation and trade surpluses, by enhancing development across various organizations. Gaining a deeper understanding of investments is essential to recognize their intricate influence on the economy. Sign up on Value Corevia and get linked to investment educators. Examples of asset classes include:

These are also referred to as equities. They represent ownership in a company or organization. Owning one means holding a share of the entity's income and assets. Learn more after using Value Corevia.

These fixed-income investments allow investors to lend money to governments or organizations. There's much to know here, and using Value Corevia is the first step to knowing more.

Professionals manage these diversified investment vehicles. Various assets make up these funds. The goal is to provide investors with a balanced and broad portfolio. An investment educator can explain this in detail. Get one through Value Corevia.

Like mutual funds, these offer a diversified portfolio of investments. They have lower transaction costs and are actively traded on stock exchanges. ETFs can get confusing without suitable information. Value Corevia leads the way to those who offer such education.

It’s misguided to think that investment education isn’t necessary simply because one doesn’t directly engage in the financial markets. In reality, everyone needs to understand investment, as they are fundamental to today’s economic system. Value Corevia provides a gateway to learning from appropriate investment educators.

Everyday financial activities, from grocery shopping to using public transportation, rely heavily on investments. Fluctuations in investment values directly influence the quality and availability of essential goods and services.

While trading and investing may seem alike, they are distinct activities that require financial knowledge to distinguish. Both involve buying and selling assets, but their approaches, objectives, and timeframes differ significantly.

Both strategies aim to make returns and share inherent risks, operating within the financial markets. However, traders focus on short-term gains through quick transactions, while investors typically adopt a long-term, more passive approach to asset accumulation.

Understanding the differences between these two strategies is crucial, and Value Corevia helps users by connecting them with investment educators for further insights.

Uncertainty lies right at the heart of investing. No one can ever know anything for sure in the markets. Outcomes are often well outside the influence of the investor. There’s always a chance that things won’t go their way. So, it’s essential for investors to understand, assess, and manage possible risks. Learn how to do so right after registering on Value Corevia.

This could cause an investor to receive returns that are lower than expected. They could even suffer losses from an investment that previously offered positive returns.

This risk arises when inflation devalues currency, leading to a reduction in the purchasing power of returns on investments. Learn more about inflation after using Value Corevia.

Sometimes, investors cannot quickly buy, sell, or yield investment returns, particularly during low trading volumes.

When investors fail to diversify, this risk emerges. If an asset class or investment performs poorly, it may lead to significant financial losses. Gain insight into managing this risk from suitable educators accessible via Value Corevia.

Also known as exchange rate risk, it affects investments made in foreign currencies. A change in the exchange rate can reduce the value of these investments.

An investor suffers losses due to a default by the party to an agreement. It is also referred to as default risk or counterparty risk. Anyone interested in investing in bonds needs to understand this risk. Register on Value Corevia to begin the necessary education.

In today's intricate economic environment, investments play a crucial role amidst swift financial shifts, often introducing greater risks. Value Corevia offers a solution for studying the art of navigating the economy, specifically investments. This website connects its users to investment educators. It is free and open to anyone eager to begin their investment education.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |